When a payment fails, merchants need fast answers. Authorize.net response codes help you understand what went wrong, whether it’s a declined card, a gateway error, or a fraud trigger. In this guide, we break down what these codes mean, how to troubleshoot them, and what you can do to reduce failed payments and customer frustration.

What Are Authorize.net Response Codes?

Authorize.net is a trusted payment gateway that helps merchants accept payments online and in person. When a customer tries to pay, the system returns a response code that explains the outcome.

These codes display if the payment was approved, declined, or blocked by an error or fraud filter. Some codes are standard across the industry, while others are specific to Authorize.net.

Why Response Codes Matter for Your Business

Each code provides information that helps you assist customers during checkout, reduce abandoned carts, and identify fraud risks. Understanding the reason behind a decline will not only help you optimize your payment settings but also help you recover sales and prevent future payment issues.

Approval Code

When you get an approval code it means the transaction was successful, and you can proceed with fulfilling the order.

| Code | Status | Description |

| 1 | Approved | The transaction was successful. No action is needed. |

Decline Codes

These are the most common reasons a credit card is declined when using Authorize.net.

| Code | Status | Description |

| 2 | General Decline | Ask the customer to contact their bank. |

| 3 | Referral to Issuer | The customer may need to verify details with their card issuer. |

| 4 | Lost or Stolen Card | Do not retry. Treat as a high-risk transaction. |

| 27 | AVS Mismatch | Confirm the billing address with the customer. |

| 44 | CVV Decline | Ask the customer to re-enter the CVV code. |

| 45 | AVS and CVV Mismatch | Consider blocking further attempts from using the card. |

| 65 | CVV Mismatch | Recommend verifying the card details or trying a different card. |

| 250–254 | Fraud Filters Triggered | Review your fraud detection settings. |

These codes usually point to customers’ input errors or card issuer declines, but they may also highlight fraud protections that need to be taken seriously.

Extended Decline Codes and System Errors

Some codes highlight technical issues with the card issuer or deeper issues with your fraud filter settings.

| Code | Status | Description |

| 6 | Invalid Card Number | Ask the customer to check the number and try again. |

| 8 | Expired Card | Request an updated card. |

| 11 | Duplicate Transaction | Space out transactions and avoid sending identical requests. |

| 13 | Invalid Login | Verify your API credentials. |

| 17, 28 | Configuration Issues | Review your gateway settings and field requirements. |

| 52 | Notification Failure | Make sure your webhook and email alerts are working. |

| 127 | AVS Mismatch (Advanced) | Review and fine-tune your AVS filters. |

| 200–224 | Processor Errors | Contact your acquiring bank or processor for assistance. |

| E00118 | Blocked IP | Investigate why the IP was flagged or blocked. |

These codes are usually fixable by adjusting the settings in your merchant account or payment gateway integrations. False declines are a common occurrence when your fraud filters are too aggressive. Check for patterns in your decline history if you’re seeing recurring patterns with certain codes.

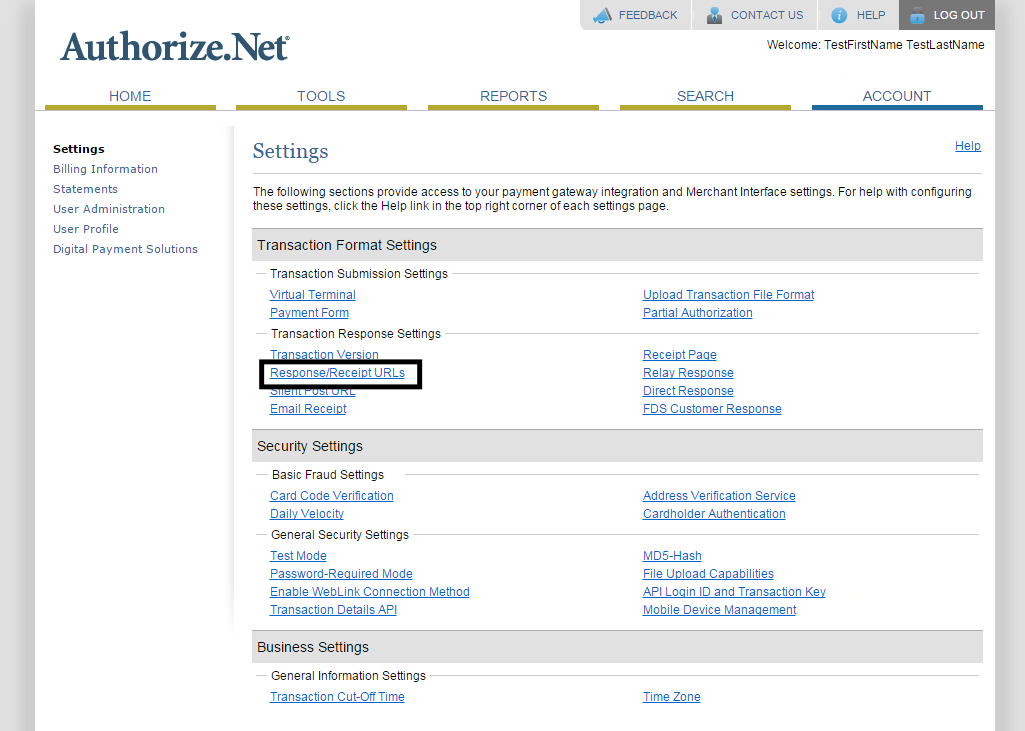

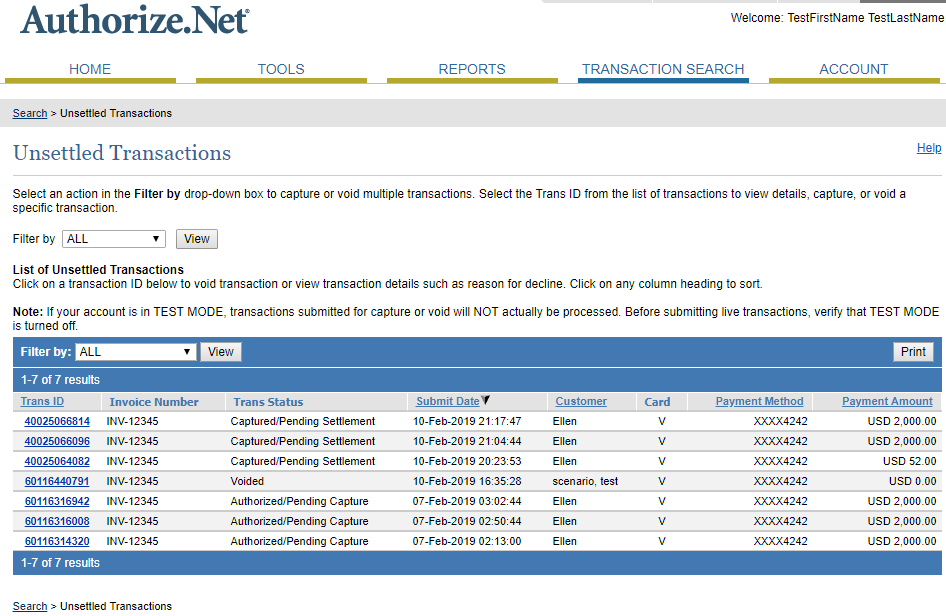

How to View Your Response Codes

You can find the response code for any transaction inside your Authorize.net dashboard. Go to the “Transactions Search” tab and click on any entry. There you’ll see:

- The response code

- A brief explanation of the transaction

- CVV and AVS results

- Any triggered fraud filters

Best Practices for Managing Credit Card Processing Codes

You can’t control your customers’ card status, but you can control how your system responds. Here are a few tips to help you avoid false declines and keep valid customers from getting blocked.

- Regularly test your payment settings with “dummy” transactions

- Keep your API credentials up to date

- Offer multiple payment methods like cash, ACH, and digital wallet

- Notify the customer immediately when a payment fails

- Do not retry cards that trigger fraud codes

How AllayPay Helps You Stay Ahead

If you’re dealing with frequent declines, our team of agents can audit your merchant account and help you avoid any more lost revenue. We work with Authorize.net and other top payment gateways to help you troubleshoot response codes and configure fraud filters to prevent any unnecessary declines. We’re experts at supporting high-risk businesses with complex needs.

Ready to optimize your payment gateway setup? Contact us now for help with Authorize.net setup, troubleshooting, and fraud filter settings. Having a quality processing partner like AllayPay in your corner will help prevent any configuration issues.